Consumer Price Index (CPI), with inflation reaching a staggering 6.21% in October 2024—its highest level in over a year. This increase is primarily driven by soaring food prices, particularly for essential items like vegetables, which have seen dramatic price hikes. As the cost of living rises, consumers are feeling the pinch, prompting changes in spending behavior and raising concerns about economic stability

What is CPI?

The Consumer Price Index measures average change over time in prices paid by consumers for a basket of goods and services. Examples of such a basket include basic items such as food, clothing, housing, transport, and healthcare. The Consumer Price Index is the principal indicator used in measuring inflation levels that prevail in an economy. High inflation implies an environment where the consumption indices are generally on the rise, hence eroding purchasing power and resulting in a “breakdown in the overall economic stability.“.

Recent Trends in CPI

October 2024 Spike

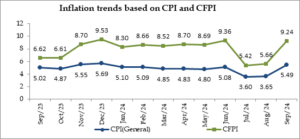

Since October 2024, inflation in India has touched 6.21%. This figure was last witnessed nearly 14 months back. The reasons behind this alarm are particularly important because one month back, that is, in the month of September 2024, the inflation rate touched 5.49%. This upward jump indicates that the inflationary pressures are mounting and largely on account of increasing food prices.

Year-on-Year Comparison

Comparing data annually, October 2024 also substantially runs higher than 4.87% recorded last October 2023. These trends raise alarms over the continuation of consumer spending and in general, the economic growth of the country.

Factors driving inflation.

The main causes of this inflationary trend in India are:

- Food Prices: Food prices were the biggest drivers of recent CPI hikes. Inflationary pressures thus appear strong in essential food items such as vegetables–tomatoes, onions, and potatoes. At least at least the price increases for vegetables have been seen to surpass 35% in the last few months. This trend of increasing food prices also impacts the wallet and psyche of consumers.

- Great gulf actually divides rural and urban inflation-whereas it was at 6.68% in October 2024 in rural CPI inflation, as little as 5.62% in cities. Such disparities reflect the urgencies with which the consumer would be dealing in the different zones and thus households located in the rural area are often more vulnerable to food price shocks.

- Core Inflation: Non-food and fuel prices, the volatile components of inflation, rose to a 10-month high at 3.7% in October 2024. This suggests that underlying price pressures are building beyond food costs, problematic for monetary policy.

Consequences for Consumers

The consequence of the rise in CPI directly affects consumers in India:

- Increased Cost of Living Inflation raises the cost of living. Households are stretched to chase after their budgets with higher costs of basic needs such as food and shelter. Low-income families, in this case, are the worst casualties because their large percentage of expenditure is on the same basic commodities such as food and shelter.

- Impact on Consumer Behavior: With the increase in price, their consumer behavior would change. Families would curtail their discretionary spending and look for cheaper alternatives for the more essentials. This may have consequences for businesses which grow as a result of consumption by people.

Implications for policymakers

For policymakers, and specially the one in India Reserve Bank, rising inflation poses critical challenges:

- Monetary Policy Shocks: RBI seeks an inflation of about 4% within a band of 2%. The latest inflation rate more than that target rate would make RBI shift from the monetary policy. In this context, early hopes that the possibilities of rates-cut existed as the inflation numbers have been low at the start of the year have added complexity.

- The problem here is that policymakers are constrained between growth and price stability. If inflation is allowed to rise any further, monetary authorities might be constrained to carry out even stricter policies, which would dilute the economic recovery.

Future Developments

Looking forward, economists‘ views about possible trends in future inflation are mixed:

- Relief is likely to come only temporarily in November, say analysts, because of positive base effects from the last year‘s data and some recent softening in vegetable prices. Headline inflation may ease modestly in November, however, if other essential items continue to incur price hikes, this relief will only be temporary.

- Other concerns include persistent high food inflation, which may also dictate future economic policies in addition to consumer behavior. Whether supply chain disruptions and adverse weather conditions will continue to cause higher food prices or push them upward, we might be seeing protracted pressure on the overall CPI numbers.

Conclusion:

India’s latest CPI reflects an important spiky pattern which challenges both the consumer and policymakers at large. It hence calls for being aware of these trends to gauge appropriate financial decisions and future economic conditions at large.

Now, knowing the CPI rate of inflation and inflation rates is crucial because its cost would increase while changing consumer spending patterns. Policymakers at the RBI and the government level will have to think about monetary policies that can balance things out, stabilizing prices yet supporting the growth of the economy.

With such trends in view and what these may portend, we are much better-equipped for the emerging economic scenario in India. This blog post provides broad CPI and inflation trend overview while keeping readers engaged with relevant data and analysis tailored for your finance page!

Thanks for reading! Keep exploring alloftop.com for the latest in tech, science, business, lifestyle, and beyond. Stay informed with us, and always be ahead of the curve!